CPE Tech drops over 14% on Main Market debut

by XM Admin

Pautan

KUALA LUMPUR (Dec 7): Engineering precision parts manufacturer CPE Technology Bhd ended its maiden trading day on the Main Market of Bursa Malaysia at RM91.5 sen, down 14.49% from its initial public offering (IPO) price of RM1.07.

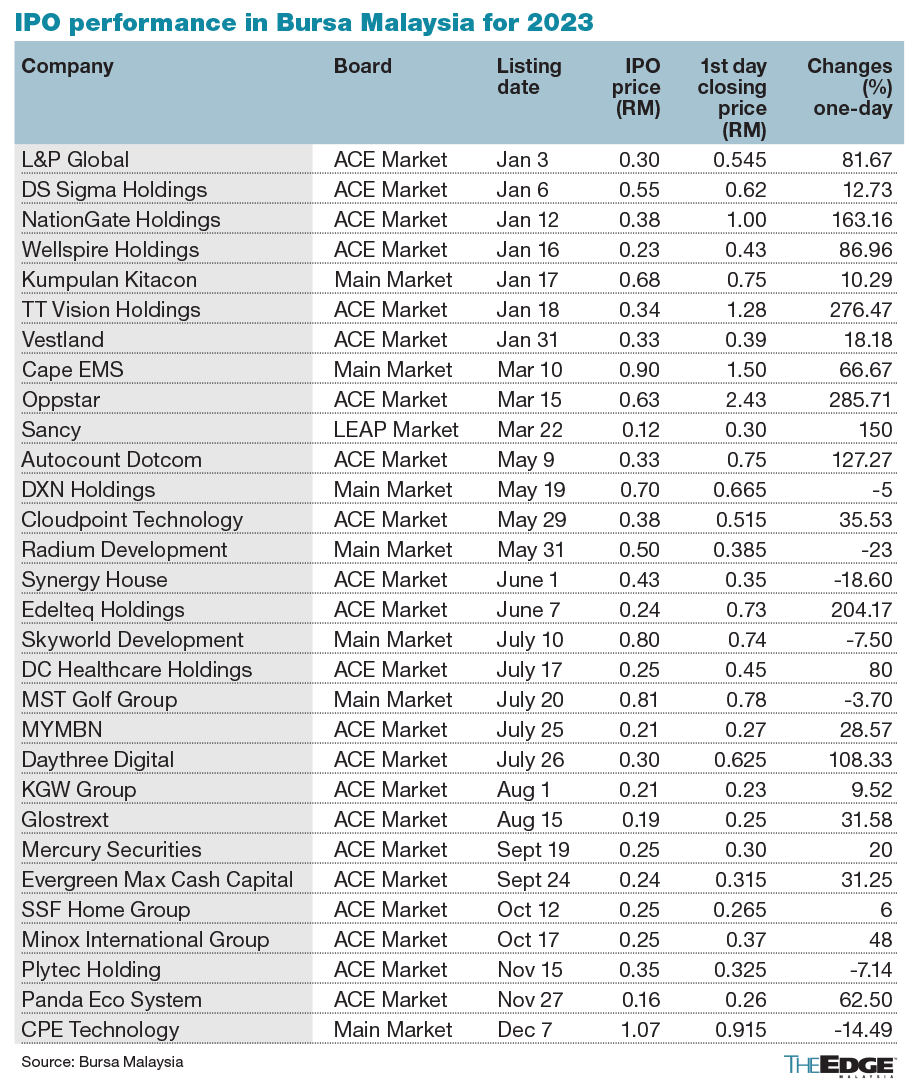

This makes it the third most underperforming IPO so far this year among the 30 new stocks listed on Bursa in 2023. Radium Development Bhd is the worst-performing IPO (dropping 23% from its IPO price of 50 sen), followed by Synergy House Bhd (which fell 18.6% from its IPO price of 43 sen).

Prior to its market debut, CPE’s IPO portion for the Malaysian public was oversubscribed by 17.69 times.

At the closing price of 91.5 sen, the group has a market capitalisation of RM614.25 million. The stock saw 76.2 million shares traded — making it the third most actively traded stock of the day on the local bourse.

CPE is involved in the manufacturing of precision-machine parts and components, besides the provision of computer numerical control machining services. Its main customers include those in the semiconductor, life science and medical devices, and sports equipment industries, with key clients in the US, Singapore and Malaysia.

As of end-June, the group held a 1.55% share, equivalent to revenue of RM145.35 million, of the engineering supporting industry (ESI) in Malaysia that was estimated to be worth RM9.37 billion in 2022.

At a press conference after the group’s listing on Thursday, CPE executive director and chief executive officer Lee Chen Yeong said growth in the local ESI may be hampered in the short term by headwinds such as global economic slowdown, heightened inflation rates and subdued consumer spending.

But there is growing demand for engineering support from other end-user industries, such as the life science and medical technology industry, that will sustain the local ESI, which will likely offset the decline in the semiconductor industry, he said.

“There will be market adjustments because of market settlement between the US and China. [But] we are positive on the semiconductor industry as the sector is expected to recover in 2024,” he said, adding that orders from semiconductor customers are likely to be bolstered by demand from enterprise-driven markets such as enterprise networking, enterprise computing, industrial, medical and commercial transportation.

“We have some inquiries, especially from our customers in the US and Japan,” Lee added.

For the first quarter ended Sept 30, 2023 (1QFY2024), CPE posted a net profit of RM2.57 million on revenue of RM22.7 million. The semiconductor segment contributed a significant 59.7% to its revenue, followed by sports equipment with 16.5%, and life sciences and medical services with 10.3%.

The US is its biggest market, contributing 58.4% of its revenue during the quarter, followed by Singapore at 19.04%, Malaysia at 17.04%, Italy at 1.68%, and Japan at 1.64%.

CPE raised M179.58 million from its IPO via the issuance of 167.83 million new shares. It plans to use RM69.6 million of the proceeds for the acquisition of industrial land and to construct new plants, RM46.91 million to part-finance its working capital, RM32.88 million to buy new machinery and equipment, as well as to relocate existing machinery and equipment, and RM17.45 million to repay bank borrowings.

About RM11.32 million has been earmarked for estimated listing expenses, with the remaining RM1.42 million to be used to part-finance other capital expenditure requirements.

KAF Investment Bank Bhd is the principal adviser, underwriter and placement agent for the IPO.